Practice Safe Checks

Process

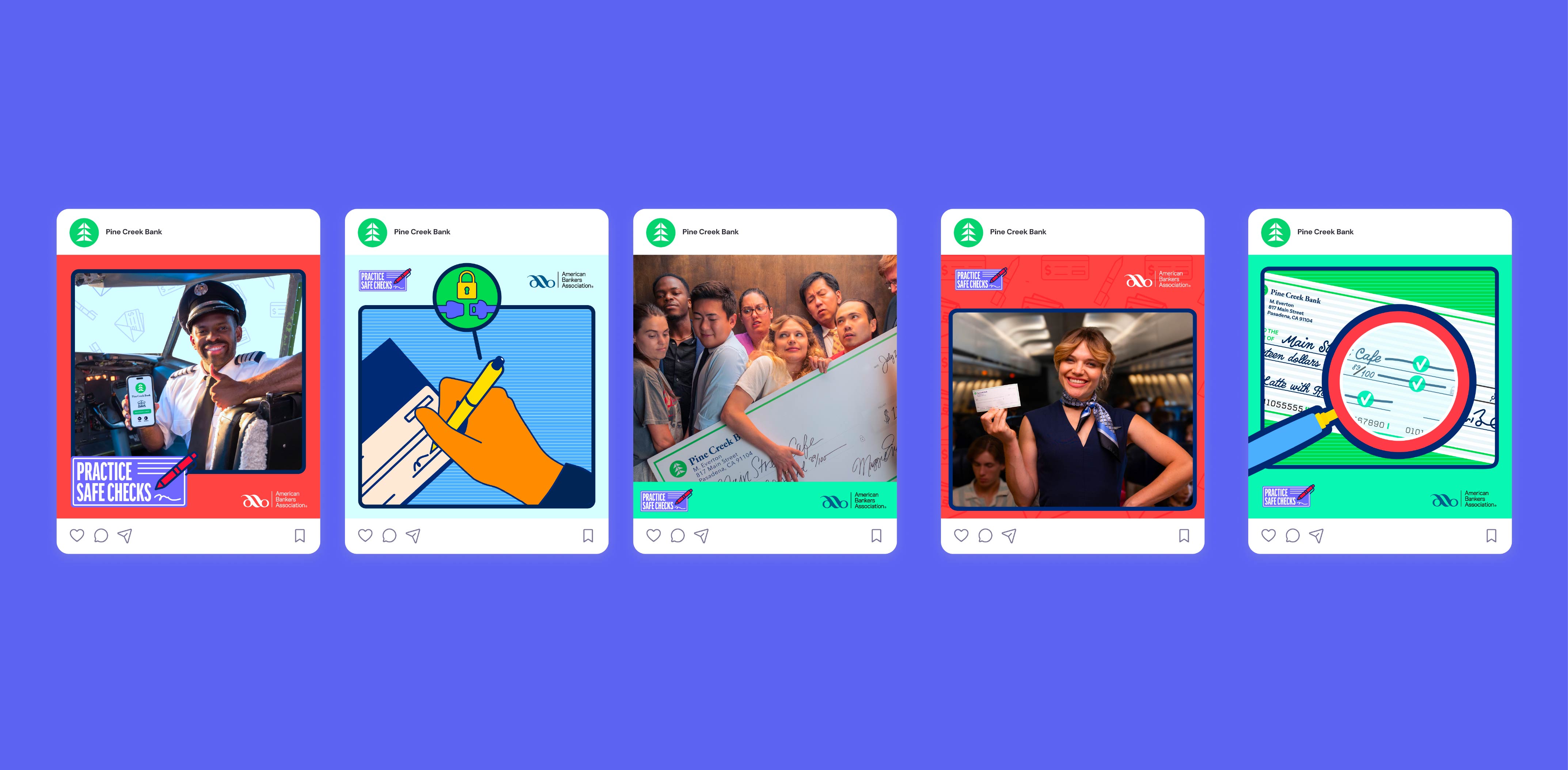

We began by creating a friendly and flexible identity rooted in clarity and wit. Bold typography, simple illustrations, and a confident yet approachable tone make the content easy to understand without ever feeling heavy.

A strategic messaging framework, informed by behavioral psychology, ensures that every piece of guidance is easy to recall and act on. We extended the system with videos, social graphics, email templates, infographics, and printed materials so financial institutions can share the campaign consistently and effectively.

At the center is PracticeSafeChecks.com, a clean and scrollable website that explains common scams, shares step by step safety checklists, and provides banks with easy to use tools for community education. The experience is designed to be mobile first, accessible, and quick to read for people of all ages.

Awards

The campaign received significant recognition, earning multiple awards for creative public education and strong digital strategy. It was celebrated for turning a confusing and stressful topic into something clear, inviting, and effective, showing that clever design can truly influence and improve everyday behavior.

Practice Safe Checks is transforming how financial institutions talk about scams. It replaces fear with empowerment and complexity with clarity. With a refreshed identity and an intuitive website, the campaign gives consumers the knowledge they need to stay ahead and sets a new standard for scam prevention efforts.